How the CARES Act Can Help Drivers Who are Unemployed Due to COVID-19

As part of the CARES Act, the federal government created three new programs for people who are unemployed or out of work due to COVID-19. Because unemployment compensation is one of the most important parts of the newly enacted CARES Act, we wanted to take some time to expand just on this topic, specifically as it may relate to rideshare drivers.

13-week extension - For drivers who have held part-time or full-time “traditional” employment (as discussed in more depth below), traditional unemployment benefits have been extended by 13 weeks, on top of the regular 26 weeks that are available in most states. Eligible applicants can now receive a total of up to 39 weeks of unemployment compensation.

Additional $600 per week - You also may receive a larger weekly benefit amount. There is an additional compensation of $600 per week for weeks of unemployment in the spring and summer of 2020.

Unemployment assistance for self-employed/independent contractors - Finally, there’s a brand new unemployment assistance program for self-employed people and independent contractors — which includes rideshare driving and other gig-economy work. This is called the Pandemic Unemployment Assistance (PUA) program, and it provides up to 39 weeks of unemployment compensation for eligible applicants.

The majority of people who drive with Lyft do so in their spare time, on top of a regular full-time or part-time job elsewhere. If you lose your traditional full-time or part-time job, you may be eligible for unemployment assistance through regular state unemployment programs — and also for the 13-week extension and additional $600 per week described above.

However, if you make most of your earnings through driving with online platforms like Lyft, instead of through a traditional job, and you’re unable to work due to COVID-19, you’re now likely eligible for the new Pandemic Unemployment Assistance (PUA) Program.

Generally, you’re either eligible for regular unemployment or the new PUA program for independent contractors, but you can’t receive both types of unemployment assistance at once. The additional $600 per week is available no matter which unemployment program you’re eligible for.

While this may sound confusing, we’re here to help with some FAQs. State and federal guidance is changing rapidly, but we’re working around the clock to keep you up-to-date.

FAQs for drivers with a traditional full-time job and spare-time Lyft earnings

We know the vast majority of you drive with Lyft part-time, or between other jobs. Here are some FAQs for you:

I still have a traditional full-time or part-time job with an employer and I make most of my earnings there. I drive with Lyft in my spare-time. I have recently paused my driving. Am I eligible for the new PUA program?

If the majority of your earnings are still coming in through a traditional full-time or part-time job, it is unlikely that you are eligible for the PUA, the type of unemployment compensation assistance that is reserved for independent contractors, business owners and/or the self-employed -- people without traditional employment. Every state is handling these claims differently.

I’ve been laid off from my traditional job and normally drive with Lyft for a few hours a week, but now I’m driving more. Am I eligible for “regular” unemployment or the new PUA program?

If you were laid off from your traditional job, you should apply for regular unemployment benefits. If you are eligible for regular unemployment benefits, you are likely not eligible for the new PUA program.

Some states are calculating total pandemic unemployment assistance based on all lost income — both employment wages and self-employment earnings. But our understanding is that currently that is only happening in a small minority of states.

I had a regular part-time job which I lost due to COVID, but it was only a small part of my earnings. The primary source of my earnings was from driving with Lyft. Am I eligible for the new PUA program?

In general yes, but it could depend on your state.

For drivers who primarily rely on income from “gig economy” work like driving for rideshare, you are “self-employed” according to PUA regulations, and so you are eligible for the new PUA program for self-employed people and independent contractors. This is the case even if you have part-time earnings from a regular job (like working in a bookstore 10 hours per week), because you primarily rely on income from your self-employed rideshare work with Lyft.

However, some states are requiring applicants to exhaust all “regular” unemployment benefits first (by applying for unemployment benefits via your traditional part-time job first) before you’re eligible for the new PUA program’s assistance. Only a few states are operating this way, and we are working hard to understand which states are requiring this. We will communicate more as soon as we know more.

FAQs for drivers who make most of their earnings through a mix of “gig economy” self-employment platforms (Lyft, Uber, Airbnb, etc)

I don’t have a traditional full-time job but I do have several gig economy jobs. My income is down across the board. Am I eligible for the new PUA program?

Yes. The CARES Act was intended to provide assistance to workers who experience “partial unemployment” as a result of COVID-19. Guidance from the U.S. Department of Labor (DOL) says that drivers who have lost income due to unsustainable losses in rider demand should be eligible to receive some types of unemployment assistance regardless of whether that lost income is from total unemployment, or because the COVID-19 public health emergency has severely limited your ability to continue performing your customary work.

Do I have to stop driving completely to apply?

As above, DOL guidance indicates that you do not need to stop driving completely to be eligible for PUA assistance. The CARES Act was intended to provide assistance to workers who experience “partial unemployment” as a result of COVID. Even if you are still receiving some earnings, the guidance indicates that the new PUA program may make up the difference.

How do I know if I’m eligible for PUA?

In order to qualify for the new PUA program, you must primarily rely on earnings through self-employed work, like driving with Lyft, and you must be unable to work because of COVID-19. There are a couple of qualifying reasons beyond the ones you may expect, and they include:

You work as an independent contractor and are unemployed, under-employed, or unable to work because the COVID-19 public health emergency has severely limited your ability to continue performing your regular work.

You or a member of your household are unable to work because you have been diagnosed with COVID-19 or are experiencing symptoms of COVID-19 .

A child or other person in the household for whom you have primary caregiving responsibility is unable to attend school or another facility that is closed as a direct result of the COVID-19, and you are unable to work because you are caring for them.

Am I “self-employed”?

Under your agreement with Lyft, you are classified as an independent contractor, and you are therefore self-employed. Congress and the U.S. Department of Labor included rideshare drivers under the category of “self-employed” workers within the new PUA program.

While some states are struggling with standing up new systems and legal issues regarding how drivers should apply for PUA, we have been communicating around the clock with state agencies pushing for a streamlined “self-certification” process and fast-track processing of applications and checks. Many states have responded, and we are seeing more states move toward a fast-track, self-certification process, where drivers are able to fill out applications and receive checks quickly.

What is a “gig-economy worker?”

The federal guidance for PUA talks about “gig-economy workers”, and this may come up in your application. There is no official definition of “gig worker” in state or federal law. Individuals who get paid by the “project”, “event,” or “gig” (like freelance writers, translators, musicians, artists, event production), or who sell goods or services using online platforms (like Lyft, Task Rabbit, Etsy, Airbnb, Shopify, DoorDash, Postmates, Zeel) are generally considered gig-economy workers, which is included in the definition of “self-employed” under federal law. Whether you make the majority of your earnings driving with Lyft, or you are a full time teacher and only drive with Lyft in your spare time, you are part of the “gig-economy.” However, some self-employed people who are part of the “gig-economy” are eligible for PUA, but not all of them, as discussed above. You have to primarily rely on your earnings from the gig economy in order to apply for PUA.

Application Process: For Regular Unemployment Assistance or the New PUA Program

How do I apply?

Regardless of whether you are eligible for regular unemployment assistance because you’ve lost a traditional full-time or part-time job, or are applying for the new PUA program, you can apply through your state’s unemployment office (a list of state offices is available here).

What information do I need to apply?

Requirements differ by state, but for both regular unemployment and PUA, you will likely need some or all of the following information to apply:

Social Security Number

Driver’s license or motor vehicle ID card number (if you have either one)

Mailing address and ZIP Code

Phone number

Alien registration card number (if you are not a U.S. Citizen)

Names and business address of your self-employment

Employer Registration Number or Federal Employer Identification Number (if you have W2 earnings)

Historical earnings records (details below on how to find them for your earnings through Lyft)

Tax documents, such as Form 1040 and any schedules, 1099s, or W2s (if you have them)

Lyft drivers can use the following info to apply for PUA as an independent contractor:

Company name: Lyft, Inc.

Phone number: 855-865-9553

Mailing address: 185 Berry Street Suite 5000 San Francisco, California 94107

Fed Tax ID #: 20-8809830

When is the new PUA program assistance available?

Many states are still in the process of establishing their PUA programs and applications. However, under the CARES Act, PUA benefits can be claimed retroactively beginning January 27, 2020, and until December 31, 2020.

I believe I am eligible for PUA, but I can’t find the application on my state’s website. What should I do?

Not all states have established separate processes for PUA yet, so we encourage you to check back frequently if the PUA application process is not currently available in your state.

In some states, you may first need to apply for regular unemployment insurance before applying for PUA. Some states are making new, stand-alone applications for PUA, and paying out benefits based on your combined income. We are advocating for other states to follow this model. Lyft is actively working with state unemployment offices to streamline the application process for independent contractors to ensure eligible drivers receive benefits as quickly as possible.

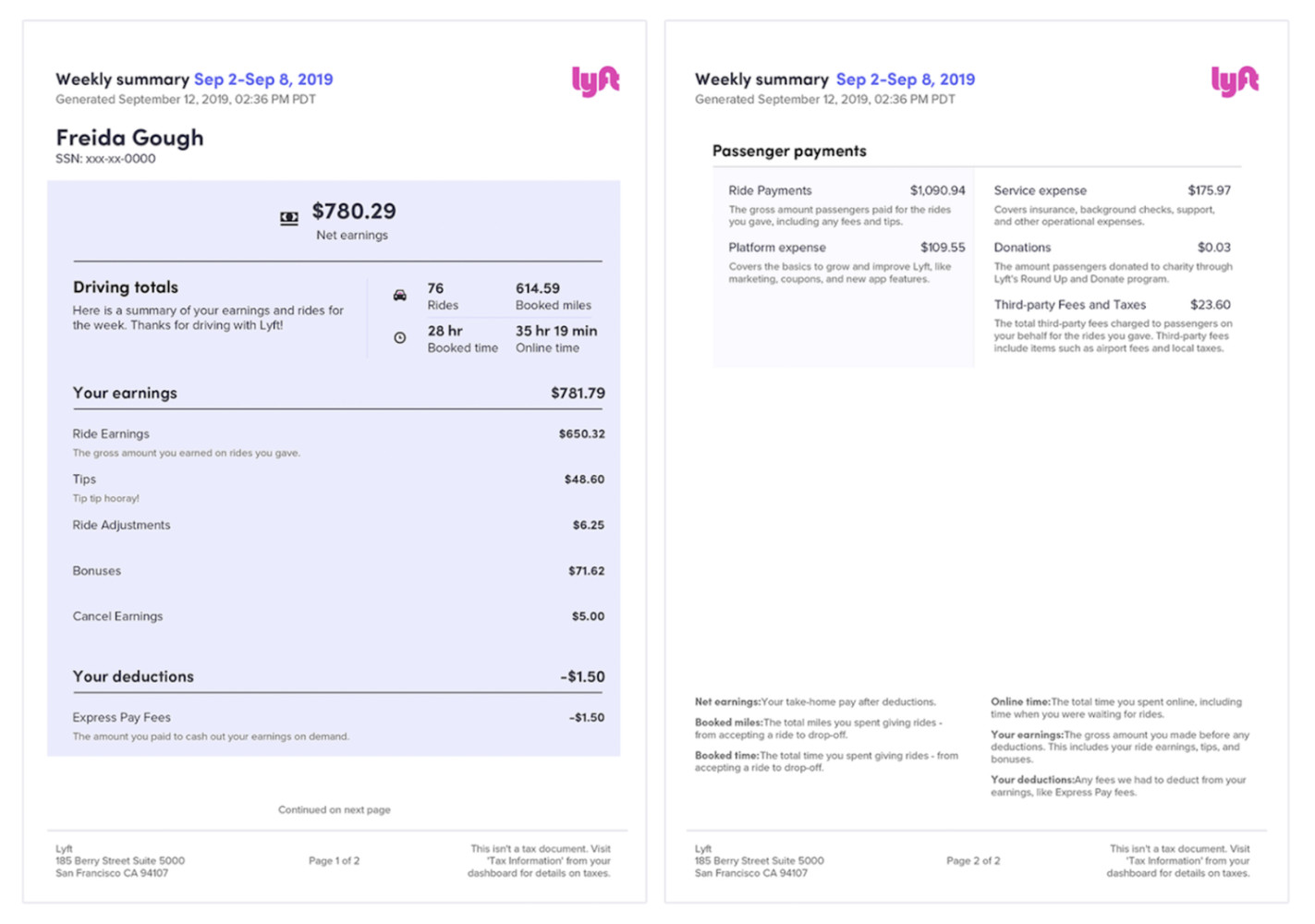

The state unemployment website or the new PUA program website say that I need to enter my past earnings. Where can I find my earnings records in the Driver Dashboard?

PDFs of your annual and weekly earnings statements are easily available for download or printing on the web dashboard:

From a web browser, log onto your driver dashboard (https://www.lyft.com/login)

Annual earnings statements and tax forms (if necessary) are available from the web dashboard or app: Driver Dashboard > Tax Information > Documents

Weekly earnings statements are available on the web dashboard:> Driving History > Select Week of Driving > Select "Download Weekly Summary"

If you need to screenshot your earnings using your mobile device instead, there are two ways to view historical weekly earnings in your app:

Option 1: driver app > $ (earnings tab) > See weekly breakdown

Option 2: driver app > Dashboard > Driving History

Categories

COVID-19CARES Act