If you've been in an accident and it’s an emergency, call 911. Learn more here.

All things insurance, all in one place.

Insurance for rideshare drivers doesn’t have to be confusing. We’re here to help you understand what you need, what Lyft’s insurance covers, and what to do in an accident.

What you need to drive with Lyft

Drivers are required to have auto insurance that meets minimum state coverage requirements.

Keep in mind that most personal auto policies will not cover you while you’re driving with Lyft.

For complete coverage whenever you drive, consider buying a rideshare insurance policy or a rideshare endorsement.

To learn more about our insurance coverage, see our FAQs.

What Lyft’s insurance covers

There are three distinct periods that determine your insurance coverage while driving.

Coverage when the app is off

Your personal auto insurance coverage applies. If you rented a car through Express Drive, the standard insurance included applies.

Coverage when the app is on and drivers are able to receive ride requests

Lyft maintains third-party liability insurance for covered accidents if your personal insurance does not apply of at least: 1

- $50,000/person for bodily injury

- $100,000/accident for bodily injury

- $25,000/accident for property damage

Coverage when the app is on and drivers are en route to pick up passengers, or during rides

Lyft maintains the following insurance for covered accidents:

- In most markets, at least $1,000,000 for third-party auto liability coverage (these limits are lower and/or not procured in certain markets, exceptions noted below)2

- First party coverages, which may include uninsured motorist coverage,

underinsured motorist coverage, PIP, MedPay, and/or Occupational

Accident coverage - If a driver obtains comprehensive and collision on their personal auto

policy, Lyft then maintains contingent comprehensive & collision coverage

up to the actual cash value of the car ($2,500 deductible)

Coverage when the app is on and a ride is in progress

Lyft maintains the following insurance for covered accidents:

- At least $1,000,000 for third-party auto liability coverage*

- First party coverages, which may include uninsured motorist coverage,

underinsured motorist coverage, PIP, MedPay, and/or Occupational

Accident coverage. - If a driver obtains comprehensive and collision coverage on their personal auto policy, Lyft then maintains contingent comprehensive & collision coverage up to the actual cash value of the car ($2,500 deductible)

1 For covered accidents in Arizona and Nebraska, third-party liability insurance is $25,000/per person for bodily injury; $50,000/accident for bodily injury and $20,000/accident for property damage, consistent with state requirements. For rides with (i) Taxi and Limousine Commission (TLC) drivers originating in the five boroughs of New York City and specific NY counties (Westchester, Nassau, Suffolk, Dutchess, Ulster, and Rockland), and (ii) livery and/or Transportation Charter Permit (TCP) drivers countrywide, Lyft does not procure insurance. TLC, livery, and TCP drivers procure their own policies consistent with state and local requirements.

2 For covered accidents in Maryland, third-party liability insurance is $125,000 (combined single limits for bodily injury and property damage) during the time in which a driver is en route to pick up a passenger, consistent with state requirements. For rides with (i) TLC drivers in the five boroughs of New York City and specific NY counties (Westchester, Nassau, Suffolk, Dutchess, Ulster, and Rockland), and (ii) livery and/or TCP drivers countrywide, Lyft does not procure insurance. TLC, livery, and TCP drivers procure their own policies consistent with state and local requirements.

* For rides with (i) TLC drivers originating in the five boroughs of New York City and specific NY counties (Westchester, Nassau, Suffolk, Dutchess, Ulster, and Rockland), and (ii) livery and/or TCP drivers, Lyft does not procure insurance. TLC, livery, and TCP drivers procure their own policies consistent with state and local requirements.

OUR TRUSTED AUTO INSURANCE PARTNERS

What to do in an accident

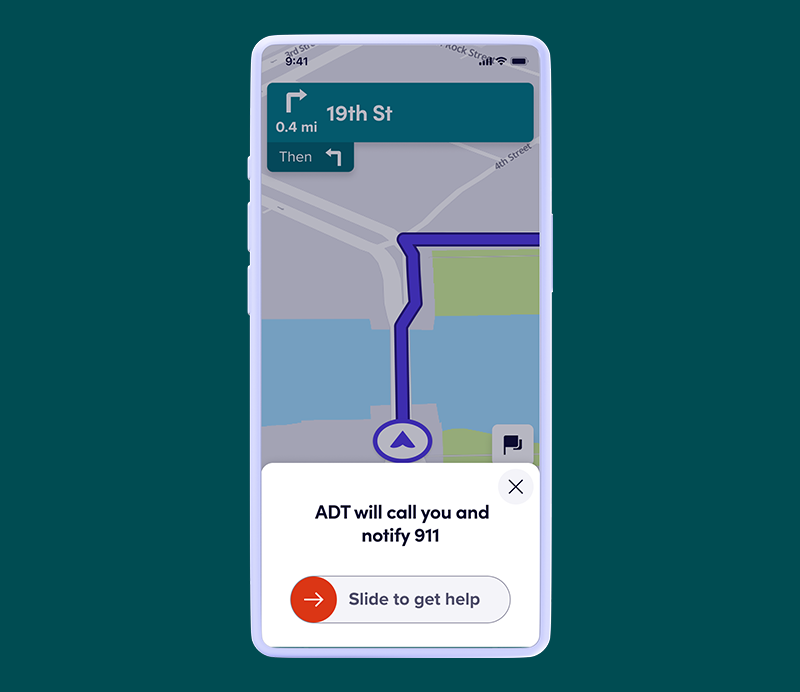

Get emergency help

Quickly connect with an ADT security professional directly from your app. They can share important ride details with 911.

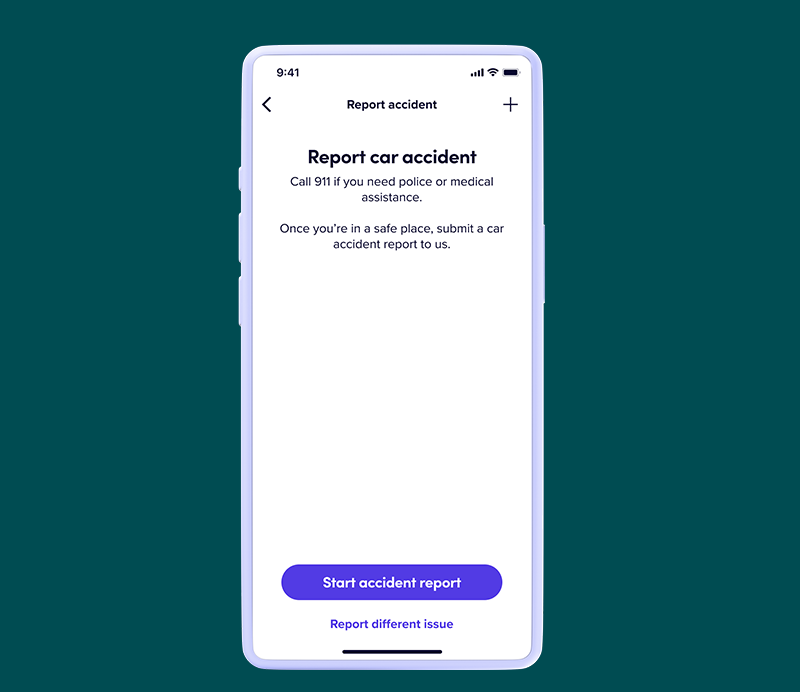

Report your accident

If you were in a collision, report your accident here. Our Claims Customer Care team is available 24/7 and will guide you through the next steps.

Questions? We’ve got answers.

What is third-party auto liability insurance?

What is third-party auto liability insurance?

What is UM, UIM, MedPay, PIP, and Occupational Accident coverage?

What is UM, UIM, MedPay, PIP, and Occupational Accident coverage?

What is contingent collision & comprehensive coverage?

What is contingent collision & comprehensive coverage?

Where can I find Lyft’s proof of insurance?

Where can I find Lyft’s proof of insurance?

What insurance do I need to drive with Lyft?

What insurance do I need to drive with Lyft?

How often do I need to update my insurance?

How often do I need to update my insurance?

Who will work with me in case of an accident while driving with Lyft?

Who will work with me in case of an accident while driving with Lyft?

What if I use Express Drive?

What if I use Express Drive?

What insurance is needed for livery, TCP, and TLC drivers?

What insurance is needed for livery, TCP, and TLC drivers?

I drive with Lyft in Canada. Is insurance different here?

I drive with Lyft in Canada. Is insurance different here?

What’s the difference between commercial and personal

auto insurance?

What’s the difference between commercial and personal

auto insurance?

More questions? Find more information here.