Dear Shareholders,

My first year as Lyft’s CEO has been a hell of a ride and I’ve loved every minute of it. But my job isn’t to produce activity; it’s to produce results. I hope this letter helps you understand our results, how we achieved them, and what they mean for you and for Lyft.

Strong financial performance

2023 was a landmark year for Lyft, our most successful in quite some time. Ride volume increased every quarter year-over-year (“YoY”) — 10% in Q1, 17% in Q2, 20% in Q3, 26% in Q4 — driving Gross Bookings up 14% to a record $13.8 billion, culminating in $222.4 million in Adjusted EBITDA. And, for the first quarter in more than two years, we were Free Cash Flow positive in Q4 ‘23.

Drivers and riders fueled this progress, powering 709 million human connections — that’s 709 million car, bike, and scooter rides to and from parties, family gatherings, medical appointments, Taylor Swift concerts, workplaces, and more. That’s also hundreds of millions of opportunities for drivers to earn — in fact, drivers earned over $8 billion with Lyft last year. In the end, more riders than ever used Lyft in 2023, and in Q4 we welcomed more new drivers than we’ve had in any quarter in four years.

That’s quite a change from when I started at Lyft. As a company, we were losing ground, and our investors had weathered a lot. We’re now on a very different path.

How our business works

To understand our path ahead, it helps to understand how our business operates. About 2 million times every day, Lyft matches drivers with riders who need to get somewhere — to work, to a friend’s house, to the airport, to their child’s soccer game. We’re balancing countless variables in every single trip, including requests for pick-up, ETAs, real-time routes, efficient drop-off locations, rider prices, driver payments, and more. And we do that efficiently, 24 hours a day, seven days a week.(i)

Lyft’s operations are complicated. But our business model is simple.

Here’s the primary way Lyft makes money: Riders pay a fare to drivers through our app. We ensure that insurance costs, taxes, tolls, fees, and other expenses are paid to respective parties. We operate the platform — the software development and operations, the customer care, demand generation, insurance negotiation and so forth — and to help offset those costs, we keep about $0.09 of every dollar a rider pays. (This still leaves drivers with the lion’s share of riders’ payments after those fees and expenses — more on that in a bit.) That’s not a big margin for us, and that’s by design. Lyft operates in the world of what economists call two-sided marketplaces. We aspire to keep the driver/rider marketplace liquid through low rider pricing and fair driver earnings.

To create a profitable rideshare business, then, we’ve got to create enough ride volume to cover our costs. Anything left over is profit.

The best way to do that is to create a rideshare network that is so amazing that people choose it millions of times every day — and even more in the future. And there’s only one way to get there: customer obsession.(ii) That means focusing with laserlike precision on the needs and desires of drivers and riders so we can make it easy for them to choose Lyft. The more they love what we do, the more they’ll use us, the more profit we’ll make, and the more impact we’ll have.

Or, as I say often: Customer obsession drives profitable growth.

Going under the hood

Here are some examples of how we have brought customer obsession to life over the last year.

On-Time Pickup Promise

Insight: Lyft has long had a way to schedule rides ahead of time, and it worked pretty well. Drivers showed up when and where a ride was requested — most of the time. But now imagine a trip to the airport, when every minute counts. For those rides, pretty-good reliability is nowhere near good enough. Scheduled airport rides need to run like Swiss watches in a world of sundials.

Action: We decided to hold ourselves to a higher standard: Rides to the airport would always arrive within ten minutes of the scheduled pick-up, or we would pay up to $100 in Lyft credits to make up for it, even if riders took a different form of transportation. This commitment focused our efforts, inspiring us to fine-tune drivers’ scheduled pickup experience and ensure they got to the pick-up location on time.

Results: We released this feature in several markets over the holidays, when we knew post-pandemic travel (and travel stress) was at its highest. It paid off. We saw reliability improve, with the percentage of late drivers decreasing by 70%. In fact, we only had to remediate about 2% of eligible scheduled rides. During the campaign, scheduled airport rides grew 21% YoY (much higher than the growth in unscheduled airport rides), and overall in Q4 we completed over 1 million scheduled airport rides, an all-time high for Lyft. As a result, we’re rolling this out to other markets across the nation.

Women+ Connect

Insight: Women make up nearly half of all Lyft riders — yet comprise just 23% of all Lyft drivers and account for only 15% of driver hours.(iii) Meanwhile, according to some recent estimates, more than half of delivery drivers are women.(iv) When we looked into this disparity, we found that women and non-binary drivers can be more comfortable sharing cars with other women and non-binary riders, and vice-versa. In fact, they’d been asking for it for years, but we hadn’t been able to launch it.

Action: The lens of customer obsession clarified the size of the opportunity. And that made it clear: It was time to make this feature happen. Thanks to a cross-functional team effort, we launched Women+ Connect in September.

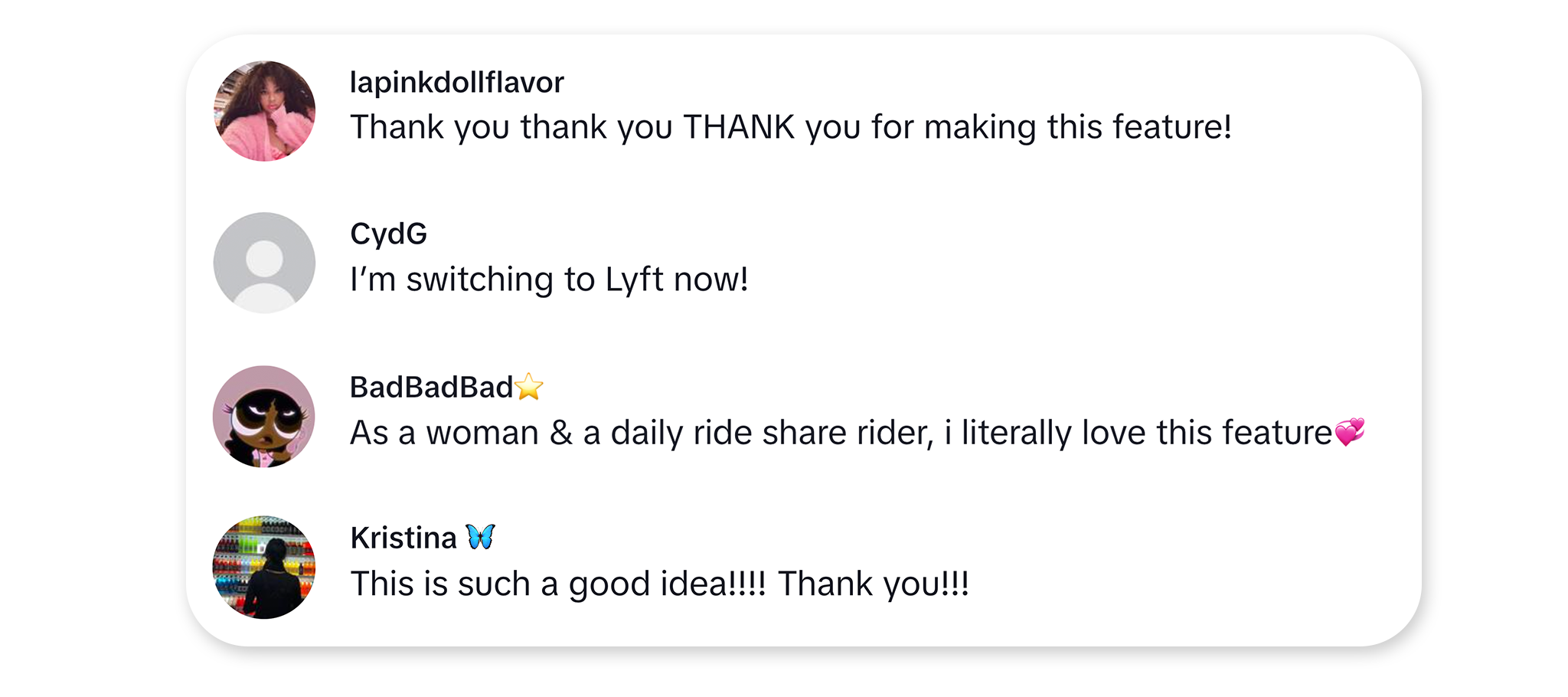

Results: Women+ Connect gives millions of people in the US a reason to choose Lyft — if you’re a woman or a non-binary driver and you prefer to be matched with women or non-binary riders, we are your best option. To date, almost half of eligible drivers and the majority of eligible riders are opted in, completing millions of rides together. And once they are opted in, they stay in — only 8% of drivers and 0.2% of riders who gave the feature a chance later opted out. We've also heard that most drivers who use the feature feel safer while driving with Lyft.

Lyft drivers and riders tell the story even better. One passenger called it “the best thing Lyft could have done for us.” A driver told us her riders “tell me they feel safer and more comfortable.” Another driver called it “a sigh of relief we breathe at the same time.” And that’s just a small sample. Check out any of our social media posts tied to this launch and see for yourself.

Driver Earnings Commitment

Insight: We want to make driving on our platform as rewarding as possible, so some of our key leaders teamed up to identify drivers’ biggest issues around earnings. They found that we hadn’t made it easy enough for drivers to understand their take-home pay. In fact, many drivers didn’t trust Lyft on this front. They’d encountered too many instances of riders paying far more than the driver made. And the earnings statements we provided were more confusing than helpful.

Action: We committed that drivers will always earn at least 70% of rider payments after external fees each week (and the overwhelming majority earn much more than this weekly). If they ever earn less, they’ll be paid the difference. We introduced more transparent weekly summaries to explain where every cent of every fare goes. And we published a detailed report that walks through what a typical U.S. driver can expect to take home after expenses like gas and maintenance. (That’s around $23.46 per engaged hour after expenses, including tips and bonuses, in the second half of 2023.)(v)

Results: Drivers recognize that we are the first and only rideshare company to guarantee their share of rider payments. Since we launched our commitment, drivers’ hours have increased, and they feel better about driving with us:

Within one month of launch, an additional 20% of drivers agreed they were paid fairly.

Within one month of launch, an additional 17% of drivers agreed they get a fair share of rider pay.

75% of drivers say they have a better understanding of their earnings.

About 1.6% more drivers have gotten on the road every week since we made the announcement.

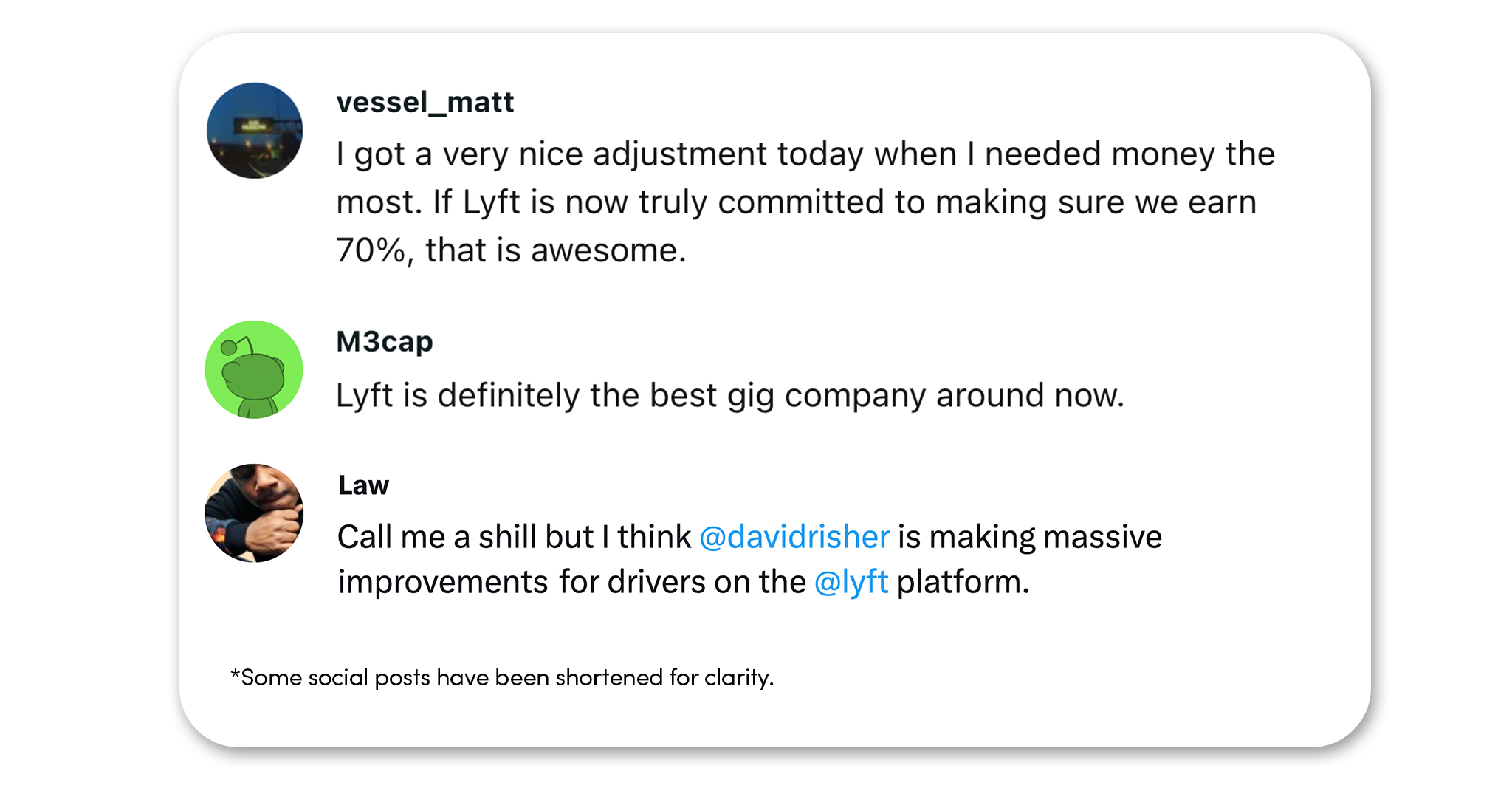

But don’t take our word for it. Ask your next driver. See if their feedback lines up with what I’ve heard:

“Wonderful, wonderful the new earnings policies and transparency measures; thank you! We need more of that shift in policies and transparency towards bonuses!”

“This is substantially more transparent than Uber…This is one step in the right direction!”

The opportunity ahead

Before I close, I’d like to talk about how I made the decision to join Lyft and why I’m more confident than ever that it was the right move.

When Lyft’s Board Chair Sean Aggarwal asked me to consider throwing my hat into the ring, my first instinct was to be flattered, but my second was to turn him down. After all, I was already serving on the Board and loved my job at Worldreader, a nonprofit organization I’d founded and led for 13 years. Meanwhile, there was no guarantee I’d succeed at Lyft. I would be trading a very certain future for a very uncertain one.

So I looked back at other big decisions I’d made in the face of huge uncertainty. In 1997, I had to choose whether to leave Microsoft for a small Internet bookstore called Amazon.com. Most people thought I was nuts to even contemplate the move.(vi)

But what was the risk, really? Sure, there was downside: Maybe Amazon would fail. Maybe I’d look foolish. Maybe the start-up life would drive me and my wife crazy, particularly with our first daughter on the way. Yet the upside! The Internet was growing crazy-fast! This was the chance to build not just a bookstore (which I’ve always loved), but an everything store!(vii) And maybe most of all, I could learn a ton from this customer-obsessed guy named Jeff. Easy call.

It’s normal to fear the unknown. That’s why uncertainty paralyzes us. But risk should not. You can assess risk by looking at the downside and upside of opportunities. You can even consciously assign more weight to the upside than the downside, to try to overcome our instinctive bias toward self-protection. And armed with that distinction, you can act.

When I looked at it that way, joining Lyft was the easiest decision I’ve ever made.

The business upside was enormous. I knew that there was still plenty of room for innovation and growth in the rideshare industry.

But most of all, I could see the opportunity to make a measurable difference in people’s lives.

At Worldreader, I learned the importance of purpose. It’s not only fulfilling, it builds an epoxy-strong culture that turbo-charges an organization.(viii) And Lyft's purpose — bringing people together — couldn't be more important, especially at a time our country is suffering from a crisis of isolation and loneliness.(ix) My best moments are when I connect with friends, family, and colleagues. And that’s exactly what our platform enables 2 million times each day.

This is the kind of purpose that motivates great companies. It certainly motivates me.

I’m extremely proud of what we’ve accomplished this year. And I’m excited about all the ways we’ll create an even more successful company in the years ahead.

Thanks for reading. I encourage you to tune into Lyft’s quarterly investor calls, and look forward to keeping you updated on our progress.

And next time you go out, please ride with Lyft!

(i) Compare this to the complexity of a very large airline. Our wonderful partner Delta Airlines flies hundreds of thousands of passengers on close to 4,000 flights each day — far fewer than the 2 million matches on our platform. Then again, they also have to defy gravity, so perhaps they have the harder job.

(ii) I’ve been lucky to have some amazing bosses over the years, including Tod Nielsen at Microsoft and Jeff Bezos at Amazon. Tod taught me to love great products; Jeff taught me how to obsess over customers. I wouldn’t be where I am today without them.

(iii) As of launch timing

(iv) “A Majority of Dashers Are Women. Here’s Why They Choose DoorDash,” published by DoorDash on August 25, 2021 and available online.

(v) “Understanding Driver Earnings & Expenses," published by Lyft on February 6, 2024 and available online through Lyft's newsroom.

(vi) Certainly Bill Gates did: He called me into his office and let me know he thought it was the stupidest idea he’d ever heard. Now that’s a badge of honor!

(vii) Thanks to Brad Stone for the term “everything store.”

(viii) I also learned the enormously important lesson that “you’re only as good as your team” from Worldreader Board Chair and my mentor, Peter Spiro.

(ix) If you want to know more, check out the op-ed in Business Insider called “Big Tech Made America Lonely,” published on October 10, 2023.

Forward-Looking Statements and Non-GAAP Financial Information

Certain statements contained in this announcement are “forward-looking statements” within the meaning of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and the Securities Act of 1933, as amended (the “Securities Act”), including statements about Lyft's expectations, strategy, priorities, plans or intentions. Such statements, which are not of historical fact, involve estimates, assumptions, judgments and uncertainties. There are a number of factors that could cause actual results or outcomes to differ materially from those addressed in the forward-looking statements. Such factors are detailed in Lyft’s filings with the Securities and Exchange Commission. Lyft does not undertake an obligation to update its forward-looking statements to reflect future events, except as required by applicable law. Information contained in websites or social media channels or accounts referenced in this letter represent the opinions of the websites and social media users and are not incorporated by reference into this letter except for the specific social media post referenced. Some social media posts are excerpted for brevity. This letter contains non-GAAP financial measures, including Adjusted EBITDA and free cash flow. A reconciliation of these measures to the most directly comparable GAAP measures is included in the proxy statement filed with the Securities and Exchange Commission on the date hereof.